Call for Abstract

Scientific Program

For a free conference video click here

-

For a quick overview of the conference click here

International Conference & B2B on Pharma Research and Development, will be organized around the theme “Overcoming the challenges in pharmaceutical research”

Pharma Research 2018 is comprised of 12 tracks and 82 sessions designed to offer comprehensive sessions that address current issues in Pharma Research 2018.

Submit your abstract to any of the mentioned tracks. All related abstracts are accepted.

Register now for the conference by choosing an appropriate package suitable to you.

In 2017 FDA has approved 34 new drugs which are presently in the market. Each year, CDER approves series of new drugs and biological products. Some of these products are often innovative new products that never before have been used in clinical practice. FDA’s classification of a drug as an “NME” for review purposes is distinct from FDA’s determination of whether a drug product is a “new chemical entity” or “NCE” within the meaning of the Federal Food, Drug, and Cosmetic Act. According to Medscape the ratio of researched drugs to eventually approved therapies at between 5,000-to-1 and 10,000-to-1. Nonetheless, if a drug manages to gain FDA approval, the cumulative direct and indirect expenses are huge. As per estimated study performed by a well-known university, the true cost to bring a drug to market was US$2.56 billion. This figure is inclusive of just shy of $1.4 billion in average out-of-pocket costs to the drug developer, as well as $1.16 billion in time costs, which are essentially the expected returns that investors forgo while a drug is in development.

Latest FDA approvals include:

|

Drug Name |

Active Ingredient |

FDA-approved use for |

|

Aliqopa |

copanlisib |

To treat adults with relapsed follicular lymphoma |

|

Alunbrig |

brigatinib |

To treat patients with anaplastic lymphoma kinase (ALK)-positive metastatic non-small cell lung cancer (NSCLC) who have progressed on or are intolerant to crizotinib |

|

Austedo |

deutetrabenazine |

For the treatment of chorea associated with Huntington’s disease |

|

Bavencio |

avelumab |

To treat metastatic Merkel cell carcinoma |

|

Baxdela |

delafloxacin |

To treat patients with acute bacterial skin infections |

|

benznidazole |

benznidazole |

To treat children ages 2 to 12 years old with Chagas disease |

|

Besponsa |

inotuzumab ozogamicin |

To treat adults with relapsed or refractory acute lymphoblastic leukemia |

|

Bevyxxa |

betrixaban |

For the prophylaxis of venous thromboembolism (VTE) in adult patients hospitalized for an acute medical illness |

|

Brineura |

cerliponase alfa |

To treat a specific form of Batten disease |

|

Dupixent |

dupilumab |

To treat adults with moderate-to-severe eczema (atopic dermatitis) |

|

Emflaza |

deflazacort |

To treat patients age 5 years and older with Duchenne muscular dystrophy (DMD) |

|

Idhifa |

enasidenib |

To treat relapsed or refractory acute myeloid leukemia |

|

Imfinzi |

durvalumab |

To treat patients with locally advanced or metastatic urothelial carcinoma |

|

Ingrezza |

valbenazine |

To treat adults with tardive dyskinesia |

|

Kevzara |

sarilumab |

To treat adult rheumatoid arthritis |

|

Kisqali |

ribociclib |

To treat postmenopausal women with a type of advanced breast cancer |

|

Mavyret |

glecaprevir and pibrentasvir |

To treat adults with chronic hepatitis C virus |

|

Nerlynx |

neratinib maleate |

To reduce the risk of breast cancer returning |

|

Ocrevus |

ocrelizumab |

To treat patients with relapsing and primary progressive forms of multiple sclerosis |

|

Parsabiv |

etelcalcetide |

To treat secondary hyperparathyroidism in adult patients with chronic kidney disease undergoing dialysis |

|

Radicava |

edaravone |

To treat patients with amyotrophic lateral sclerosis (ALS) |

|

Rydapt |

midostaurin |

To treat acute myeloid leukemia |

|

Siliq |

brodalumab |

To treat adults with moderate-to-severe plaque psoriasis |

|

Solosec |

secnidazole |

To treat bacterial vaginosis |

|

Symproic |

naldemedine |

For the treatment of opioid-induced constipation |

|

Tremfya |

guselkumab |

For the treatment of adult patients with moderate-to-severe plaque psoriasis |

|

Trulance |

plecanatide |

To treat Chronic Idiopathic Constipation (CIC) in adult patients. |

|

Tymlos |

abaloparatide |

To treat osteoporosis in postmenopausal women at high risk of fracture or those who have failed other therapies |

|

Vabomere |

meropenem and vaborbactam |

To treat adults with complicated urinary tract infections |

|

Verzenio |

abemaciclib |

To treat certain advanced or metastatic breast cancers |

|

Vosevi |

sofosbuvir, velpatasvir and voxilaprevir |

To treat adults with chronic hepatitis C virus |

|

Xadago |

safinamide |

To treat Parkinson’s disease |

|

Xermelo |

telotristat ethyl |

To treat carcinoid syndrome diarrhea |

|

Zejula |

niraparib |

For the maintenance treatment for recurrent epithelial ovarian, fallopian tube or primary peritoneal cancers |

- Track 1-1Computer Aided Drug Design (CADD)

- Track 1-2Insilco Drug Discovery

- Track 1-3Novel Detection Technologies and Drug Discovery

- Track 1-4New Chemical Entity Exclusivity Determinations

- Track 1-5Statutory and regulatory framework

- Track 1-6NME versus NCE

“The Quality cannot be tested into the product, but it should be built into it.” QbD can be attributed as a Scientific, risk-based, holistic and proactive approach to the development of a pharmaceutical product. It is more of a deliberate design effort from product conception through commercialization requiring full understanding of how product attributes and process would relate to product performance. In FDA’s Office of New Drug Quality Assessment (ONDQA), a new risk-based pharmaceutical quality assessment system (PQAS) was established based on the application of product and process understanding. The difference between QbD for NDA and ANDA products is most apparent at the first step of the process. For an NDA, the target product profile is under development while for the ANDA product the target product profile is well established by the labeling and clinical studies conducted to support the approval of the reference product.

- Track 2-1ICH Q8 and Q8(R)

- Track 2-2ONDQA QbD Pilot Program

- Track 2-3Challenges of Implementing QbD

- Track 2-4QRM :Quantitative Risk Management

- Track 2-5Uni/multi variant experiments

- Track 2-6Measurement capability

- Track 2-7CPPs :Critical Process Parameters

- Track 2-8CQAs : Critical Quality Attributes

- Track 2-9Process Performance & Product Quality Monitoring System

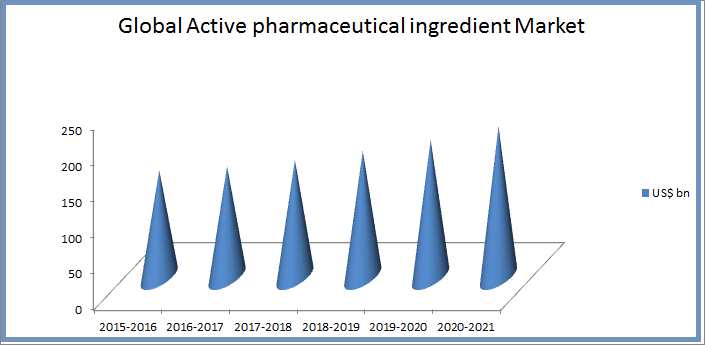

The API market in the US is as expected growing at a CAGR of 7% over the period 2014-2019. The market research and analysis estimates that in terms of geographic regions, the Americas will be the major revenue contributor to the active pharmaceutical ingredients market throughout the next four years. The increasing demand for generic drugs from countries such as the US, the growth in aging population, and the presence of an organized R&D structure for drug development are some of the major factors that will drive the growth of the market in this region. The key vendors in this sector are Abbott Laboratories, Aurobindo Pharma, Mylan and Teva Pharmaceutical Industries.

- Track 3-1API outsourcings

- Track 3-2US API market

- Track 3-3European API market

- Track 3-4Asian API market

- Track 3-5Antibody Drug Conjugate (ADCs)

- Track 3-6Highly Potent Active Pharmaceutical Ingredients (HPAPIs)

- Track 3-7Biological API market

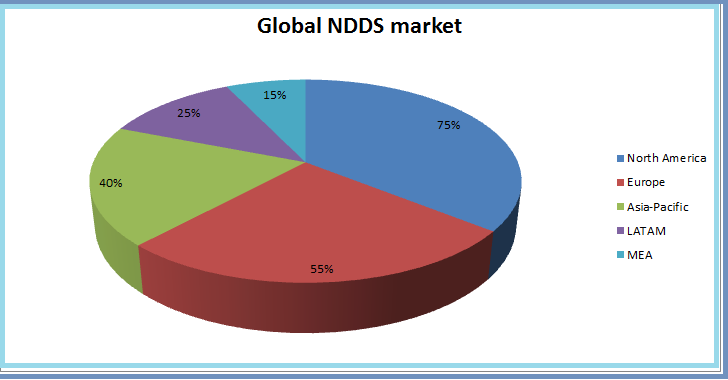

The drug delivery technology market is expected to reach USD 1,504.7 Billion by 2020 from USD 1,048.1 Billion in 2016, growing at a CAGR of 7.5% from 2015 to 2020. The global market for Novel Drug Delivery Systems (NDDS) is expected to hit USD 320 billion by the year 2021. With the rising number of patients suffering from different types of cancer, favorable reimbursement scenario in US, improved and advanced healthcare infrastructure have driven North America to become the leading regional segment in the global NDDS in cancer therapy market. Among the NDDS technologies Embolization of Particles, Selective Internal Radiation Therapy (SIRT), Holmium-based Microspheres, Liquid Embolics and Nanoparticles are gaining importance from market point of view.

- Track 4-1Pre-Formulation & Formulation Aspects

- Track 4-2Nanoparticulate Drug Delivery Systems

- Track 4-3Smart Drug Delivery Systems

- Track 4-4Medical Devices for Drug Delivery

- Track 4-52D & 3D Printing in Drug Delivery

- Track 4-6Global Drug Delivery Policy

The biopharmaceutical sector in US enjoys 17% of all domestic R&D funded by the country and in return gave $2.5 trillion cumulative addition in economic output in 2016. Companies engaged in the brand name pharmaceutical manufacturing have grappled in recent years owing to the largest waves of drug patent expirations in history. As a consequence enabling low-price generic drugs to inundate the market. Many brand name pharmaceutical manufacturers have contended with intensifying competition from generic manufacturers, cutting into revenue growth. Until the next the five years till 2022, investments in research and development that generate a high return will occur as many pharmaceutical manufacturers strengthen their drug pipeline with orphan drugs.

Recently, process engineers have shown inclination to single-use, modular and continuous manufacturing technologies to improve efficiency and minimize scale-up and technology transfer challenges in the pharmaceutical industry. Lot of these innovations are driven by updates instigated by the FDA. The changes are inevitable; especially in the already aging biopharmaceutical sector of the industry, where original processes are often overly complex, and are characterized by inefficiency, and occasionally, inherent unpredictability.

- Track 5-1Challenges in pharma manufacturing

- Track 5-2ICH Q10

- Track 5-3Knowledge transition between development and manufacturing sites

- Track 5-4Tech transfer protocols and guidelines

- Track 5-5Tech transfer key considerations

- Track 5-6Challenges in tech transfer

With greater attention to the following elements this session will discuss the all the key lookouts essential for the development of a QA/QC system in pharmaceutical manufacturing process and requires implementation in tracking inventory compilation:

· An inventory agency responsible for coordinating QA/QC activities;

· A QA/QC plan;

· General QC procedures

· Source category-specific QC procedures

· Reporting, documentation, and archiving procedures.

Market research analysts predict that the global automated industrial quality control (QC) market will grow steadily at a CAGR of around 8% by 2021.

- Track 6-1ICH:International Council for Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use

- Track 6-2" Hazard analysis and critical control point (HACCP) methodology for pharmaceuticals"

- Track 6-3WHO compendium of guidelines for pharma QA

- Track 6-4Quality management system (QMS) in cGMP

- Track 6-5Data Integrity in Pharmaceutical Quality Control Laboratories

- Track 6-6GLP compliancing

- Track 6-7cGMP compliancing

Chromatography and MS are extensively used in the formulation development stage of generic drug products. The ICH Q3B guidelines address the reporting threshold, identification threshold, and qualification threshold for impurities in the drug product. Chromatography (LC) and Gas Chromatography (GC) are extensively used to analyze stable compounds. However, for labile compounds require derivatization prior to LC or GC analysis. For certain selected analyses, Liquid Chromatography- Ultraviolet Detection (LC-UVD) and Gas Chromatography-Flame Ionization Detection (GC-FID) techniques may be deemed suitable. However, Liquid Chromatography-Mass Spectrometry (LC-MS) and Gas Chromatography-Mass Spectrometry (GC-MS) are usually the techniques of choice when higher specificity and sensitivity are required. Gas Chromatography-Electron Capture Detection (GC-ECD) techniques are commonly used for halogenated PGIs/GIs to enhance sensitivity and selectivity. Occasionally, some spectroscopic techniques like Nuclear Magnetic Resonance (NMR), light scattering, and Inductively Coupled Plasma-Mass Spectrometry (ICP-MS) are used in analyzing PGIs/GIs.

- Track 7-1Analytical Strategies in the development of Generics

- Track 7-2Analytical strategies for Biosimilars

- Track 7-3Analytical strategies for Genotoxic impurities

- Track 7-4Analytical method transfer of pharmaceuticals

- Track 7-5Integrated analytical strategies for drug discovery

Packaging is one of the largest industry sectors in the world, worth several billions. There are three major types of pharmaceutical packaging, which are: solid packaging, semi-solids packaging and liquid packaging. The pharmaceutical packaging is a very profitable industry and it is estimated that for 2022 it will reach USD. 8.24 billion. Pharmaceutical packaging represents a meagre percentage of this colossal market. The Global Logistics Market is expected to grow at a CAGR of 7.0% from 2016-2021 and CAGR of 5.6% from 2021-2027. By 2020, pharma cold-chain logistics will be worth $16.7 billion, and non-cold chain at $77.1 billion. The market was estimated at $14.84bn in 2016 and is expected to grow to $28.75bn in 2027.

- Track 8-1Cold Chain Spring

- Track 8-2Clinical Trial Supply

- Track 8-3Pharma Traceability

- Track 8-4Product Packaging & Labeling

- Track 8-5Package Engineering

- Track 8-6Warehousing & Distribution

- Track 8-7Supply Chain Strategy

- Track 8-8Worldwide Labeling Protocols

With more stringent compliance parameters set by the USFDA the quality assurance of pharmaceutical products is ensured. In addition to cGMP, GLP and GCP practices as per the US Federal law pharma products should comply with 21CFR regulations. Also on a regular basis the FDA organizes compliance programs for the pharma industries in program areas like Biologics (CBER), Bioresearch Monitoring (BIMO), Devices/Radiological Health (CDRH), Drugs (CDER), Food and Cosmetics (CFSAN), Veterinary Medicine (CVM). The results of regulatory audits NAI – No Action Indication, VAI – Voluntary Actions Indicated, OAI – Official FDA Action Indicated are also critical to decide by auditors in regards to compliance matters and call for several challenges to overcome by the manufacturers.

- Track 9-1Food and Drug Administration (FDA)

- Track 9-2Medicines and Healthcare Products Regulatory Agency (MHRA)

- Track 9-3Therapeutic Goods Administration (TGA)

- Track 9-4Central Drug Standard Control Organization (CDSCO)

- Track 9-5Health Canada

- Track 9-6European Medicines Agency (EMEA)

The global clinical trials market size was valued at USD 40.0 billion in 2016 and is expected to grow at a CAGR of 5.7% until 2025. The demand for biosimilars testing is expected to increase in the U.S. The interventional study design is the most prominent method of conducting clinical trials across with globe. According to statistics provided by the U.S. FDA, over 126,000 trials are currently being conducted by means of this method. Based on indication, the oncology segment is anticipated to witness the fastest growth. According to various sources, more than USD 38.0 billion is currently spent by the healthcare industry towards preclinical and clinical development of oncology therapy products. Hence, it is anticipated to grow at a lucrative CAGR and contribute over USD 15.0 billion towards the clinical trials market by 2025. MENA’s clinical trial revenues is expected to increase almost 10-fold over the next decade, which will build an annual market of about $1 billion.

- Track 10-1Clinical Study Designs

- Track 10-2Clinical Trials on different Diseases

- Track 10-3CRO/Sponsorship Clinical Trials

- Track 10-4Outsourcing in Clinical Trials

- Track 10-5Clinical and Medical Case Reports

Two powerful megatrends — dramatic deceleration in U.S. market growth and significant restructuring of the healthcare system — are at play in the U.S. pharmaceuticals industry. The U.S. pharmaceutical market is the world’s most important national market. Together with Canada and Mexico, it represents the largest continental pharma market worldwide. The United States alone holds over 45 percent of the global pharmaceutical market. In 2016, this share was valued around 446 billion U.S. dollars. The biopharmaceutical companies in the United States exported goods in the amount of some 31 billion U.S. dollars during 2016. In the United States, there are an estimated 100,000 OTC drug products marketed and sold in a variety of outlets, such as pharmacies and convenience stores. TH revenue for the OTC drugs also add to the pharma market growth. Top markets for pharmaceutical products continue to be developed countries in Western Europe, East Asia, and North America with high per capita spending on healthcare, growing elderly populations, and advanced regulatory systems. Though ranked lower, there are growing opportunities in developing countries like China as incomes and healthcare spending increases. The pharmaceutical sector has consistently been one of the most R&D intensive industries in the United States. The research-based industry generally allocates around 15 to 20 percent of revenues to R&D activities and invests over $50 billion on R&D annually.

- Track 11-1Generic Drugs Market

- Track 11-2Over-the-Counter (OTC) Drugs and Dietary Supplements

- Track 11-3Onco medicine market

- Track 11-4Immunology and Oncolytic Virology

- Track 11-5Biosimilars market

- Track 11-6Drug Testing Market

- Track 11-7Neglected Tropical Disease Treatments

- Track 11-8Antibody Drug Conjugates

Health economics is a tool to help us prioritise different and sometimes competing health care interventions for these fixed resources and, in doing so, health care is treated as a commodity like any other. Knowledge of health economics coupled with political insight is essential to understand resource allocation and expenditure in a modern health care system. Pharmacists, with their unique knowledge of medicine, are crucial in using pharmacoeconomic analysis to influence expenditure and distribution of resources on medicines. Design and management of pharmacoeconomic studies

· cost and burden of illness studies,

· budget impact analysis,

are very important in today’s pharmaceutical market. Moreover pharmacoeconomic approach towards

- Management of Consensus Meetings (Advisory Boards, Delphi Panels, etc.)

- Re-analysis of trials

- Implementation and customization with local data of pharmacoeconomic models

have greatly aided the pharma industries.

- Track 12-1ROI: Return on Investment

- Track 12-2Economic Evaluation Of Pharmaceuticals

- Track 12-3Quality-Adjusted Life Years

- Track 12-4Health Economics

- Track 12-5Cost-Minimization Analysis

- Track 12-6Cost-Benefit Analysis

- Track 12-7Cost-Effectiveness Analysis

- Track 12-8Cost-Utility Analysis

- Track 12-9Pricing and Market Access