Theme: Exploring the Recent Trends & Advances in the Field of Pharma Research and Innovations in Pharma Industry

Pharma Research 2022

ConferenceSeries LLC Ltd is a renowned organization that organizes highly notable Pharmaceutical conferences throughout the globe. Currently we are bringing forth “5th International Conference on Pharmaceutical Research & Innovations in Pharma Industry” (Pharma Research 2022) scheduled to be held during June 29-30, 2022 at Vancouver, Canada. The conference invites all the participants across the globe to attend and share their insights and convey recent developments in the field of Pharmaceutical Research and Innovations in Pharma Industry.

ConferenceSeries Ltd organizes a conference series of 1000+ Global Events inclusive of 1000+ Conferences, 500+ Upcoming and Previous Symposiums and Workshops in USA, Europe & Asia with support from 1000 more scientific societies and publishes 700+ Open access Journals which contains over 50000 eminent personalities, reputed scientists as editorial board members.

Details of Pharma Research Conference 2022:

|

Conference Name |

Dates |

|

June 29-30, 2022 |

2022 Highlights:

- 300+ Participation (70 Industry: 30 Academia)

- 10+ Keynote Speakers

- 50+ Plenary Speakers

- 20+ Exhibitors

- 14 Innovative Educational Sessions

- 5+ Workshops

- B2B Meetings

Motives to attend:

- Keynote presentation along with interactions to galvanize the scientific community.

- Workshop and symposiums to reach the largest assemblage of participants from the Pharma/Biotech community.

- A wide track of exhibitors to showcase the new and emerging technologies.

- Platform to global investment community to connect with stakeholders in Pharma/Biotech sector.

- Young Scientist/ Investigators Award geared towards best budding young research.

- Links to the political marketing resources in order to expand your business and research network.

- Triumph of Awards, Certificates recognizes your commitment to your profession to encourage the nascent research.

Pharmaceutical Research 2022 has everything you need:

Open panel discussions: Providing an open forum with experts from academia and business to discuss on current challenges in Pharmaceutical sciences, where all attendees can interact with the panel followed by a Q&A session.

Speaker and Poster Presentations: Providing a platform to all academicians and industry professionals to share their research thoughts and findings through a speech or a poster presentation.

Editorial Board Meeting: Discussing on growth and development of open access Pharmaceutical Sciences & Emerging Drugs Journals and recruiting board members and reviewers who can support the journal.

Round Table Meetings: Providing a platform where industry professionals meet academic experts.

Over 50+ organizations and international pavilions will be exhibiting at Pharmaceutical Research 2022 conference. Exhibitors will include equipment manufacturers and suppliers, systems providers, finance and investment firms, R&D companies, project developers, trade associations, and government agencies.

In addition to the products and services you will have access to valuable content, including Keynote Presentations, Product Demonstrations and Educational Sessions from today’s industry leaders.

The Pharmaceutical Research 2022 has everything you need, all under one roof, saving you both time and money. It is the event you cannot afford to miss!

Target Audience:

- Directors, CEO’s of Organizations

- Business Development Managers

- Chief Scientific Officers

- R&D Researchers from Pharmaceutical Industries

- Professors, Associate Professors, Assistant Professors

- PhD Scholars

- Patent Attorneys

- Intellectual Property Attorneys

- Investment Analysts

- Association, Association presidents and professionals

- Noble laureates in Health Care and Medicine

- Bio instruments Professionals

- Bio-informatics Professionals

- Software development companies

- Research Institutes and members

- Supply Chain companies

- Manufacturing Companies

- CRO and DATA management Companies

- Training Institutes

- Business Entrepreneurs

Track 1:Pharmaceutical Research and Development

For developing a new medicine it will take nearly 10-15 years and on average and costs an average of $2.6 billion. In discovery procedure comprises the initial stages of research, which are intended to recognize an investigational drug and perform primary tests in the lab. This first stage of the process takes three to six years. By the end, investigators hope to identify a capable drug aspirant to further study in the lab and in animal models, and then in people. These developments offer great ability, but also add complexity to the R&D process. In order to ensure the safety and efficacy of personalized therapies that are used along with diagnostics, clinical trial protocols must be improved and increased.

Track 2:Pharmaceutical Industry

The pharmaceutical industry discovers, develops, produces, and markets drugs or pharmaceutical drugs for use as medications to be administered (or self-administered) to patients, with the aim to cure them, vaccinate them, or alleviate the symptoms. Pharmaceutical companies may deal in generic or brand medications and medical devices. They are subject to a variety of laws and regulations that govern the patenting, testing, safety, efficacy and marketing of drugs.

Track 3:Active Pharmaceutical Ingredients

The API market in the US is as expected growing at a CAGR of 7% over the period 2014-2019. The market research and analysis estimates that in terms of geographic regions, the Americas will be the major revenue contributor to the active pharmaceutical ingredients market throughout the next four years. The increasing demand for generic drugs from countries such as the US, the growth in aging population, and the presence of an organized R&D structure for drug development are some of the major factors that will drive the growth of the market in this region. The key vendors in this sector are Abbott Laboratories, Aurobindo Pharma, Mylan and Teva Pharmaceutical Industries.

The drug delivery technology market is expected to reach USD 1,504.7 Billion by 2020 from USD 1,048.1 Billion in 2016, growing at a CAGR of 7.5% from 2015 to 2020. The global market for Novel Drug Delivery Systems (NDDS) is expected to hit USD 320 billion by the year 2021. With the rising number of patients suffering from different types of cancer, favorable reimbursement scenario in US, improved and advanced healthcare infrastructure have driven North America to become the leading regional segment in the global NDDS in cancer therapy market. Among the NDDS technologies Embolization of Particles, Selective Internal Radiation Therapy (SIRT), Holmium-based Microspheres, Liquid Embolics and Nanoparticles are gaining importance from market point of view.

Track 5:Drug discovery and NCEs

In 2018 FDA has approved 34 new drugs which are presently in the market. Each year, CDER approves series of new drugs and biological products. Some of these products are often innovative new products that never before have been used in clinical practice. FDA’s classification of a drug as an “NME” for review purposes is distinct from FDA’s determination of whether a drug product is a “new chemical entity” or “NCE” within the meaning of the Federal Food, Drug, and Cosmetic Act. According to Medscape the ratio of researched drugs to eventually approved therapies at between 5,000-to-1 and 10,000-to-1. Nonetheless, if a drug manages to gain FDA approval, the cumulative direct and indirect expenses are huge. As per estimated study performed by a well-known university, the true cost to bring a drug to market was US$2.56 billion. This figure is inclusive of just shy of $1.4 billion in average out-of-pocket costs to the drug developer, as well as $1.16 billion in time costs, which are essentially the expected returns that investors forgo while a drug is in development.

Track 6:Good Manufacturing Practices (GMP)

Good Manufacturing Practice is the part of quality management which ensures that products are consistently produced and controlled according to the quality standards appropriate to their intended use and as required by the marketing authorization, clinical trial authorization or product specification. Good Manufacturing practices conference aims at both production and Quality Control. Current Good Manufacturing Practices (cGMP) is aimed primarily at managing and minimizing the risks inherent in pharmaceutical manufacture to ensure the quality, safety and efficacy of products. FDA regulates the quality of pharmaceuticals very carefully. Current Trends in the FDA is the main regulatory standard for ensuring pharmaceutical quality

Regulatory affairs is a comparatively new profession which developed from the desire of governments to protect public health by controlling the safety and efficacy of products in areas including pharmaceuticals , veterinary medicines, medical devices, pesticides, agrochemicals, cosmetics and complementary medicines. Regulatory Affairs is involved in the development of new medicinal products from early on, by integrating regulatory principles and by preparing and submitting the relevant regulatory dossiers to health authorities. Regulatory Affairs is actively involved in every stage of development of a new medicine and in the post-marketing activities with authorized medicinal products. The Regulatory Affairs department is an important part of the organizational structure of pharmaceutical industry. Internally it liaises at the interphase of drug development, manufacturing, marketing and clinical research. Externally it is the key interface between the company and the regulatory authorities.

Track 8:Pharmaceutical Manufacturing, Scale Up and Tech transfer

Recently, process engineers have shown inclination to single-use, modular and continuous manufacturing technologies to improve efficiency and minimize scale-up and technology transfer challenges in the pharmaceutical industry. Lot of these innovations are driven by updates instigated by the FDA. The changes are inevitable; especially in the already aging biopharmaceutical sector of the industry, where original processes are often overly complex, and are characterized by inefficiency, and occasionally, inherent unpredictability.

Track 9:Quality by design(QbD) approach

“The Quality cannot be tested into the product, but it should be built into it.” QbD can be attributed as a Scientific, risk-based, holistic and proactive approach to the development of a pharmaceutical product. It is more of a deliberate design effort from product conception through commercialization requiring full understanding of how product attributes and process would relate to product performance. In FDA’s Office of New Drug Quality Assessment (ONDQA), a new risk-based pharmaceutical quality assessment system (PQAS) was established based on the application of product and process understanding. The difference between QbD for NDA and ANDA products is most apparent at the first step of the process. For an NDA, the target product profile is under development while for the ANDA product the target product profile is well established by the labeling and clinical studies conducted to support the approval of the reference product.

Track 10:QC & QA: Quality control and Quality assurance

With greater attention to the following elements this session will discuss the all the key lookouts essential for the development of a QA/QC system in pharmaceutical manufacturing process and requires implementation in tracking inventory compilation:

- An inventory agency responsible for coordinating QA/QC activities;

- A QA/QC plan;

- General QC procedures

- Source category-specific QC procedures

- QA review procedures;

- Reporting, documentation, and archiving procedures.

Market research analysts predict that the global automated industrial quality control (QC) market will grow steadily at a CAGR of around 8% by 2021.

Track 11:Pharmaceutical Packaging and Logistics

Packaging is one of the largest industry sectors in the world, worth several billions. There are three major types of pharmaceutical packaging, which are: solid packaging, semi-solids packaging and liquid packaging. The pharmaceutical packaging is a very profitable industry and it is estimated that for 2022 it will reach USD. 8.24 billion. Pharmaceutical packaging represents a meagre percentage of this colossal market. The Global Logistics Market is expected to grow at a CAGR of 7.0% from 2016-2021 and CAGR of 5.6% from 2021-2027. By 2020, pharma cold-chain logistics will be worth $16.7 billion, and non-cold chain at $77.1 billion. The market was estimated at $14.84bn in 2016 and is expected to grow to $28.75bn in 2027.

Track 12:Analytical strategies for pharmaceutical products

Chromatography and MS are extensively used in the formulation development stage of generic drug products. The ICH Q3B guidelines address the reporting threshold, identification threshold, and qualification threshold for impurities in the drug product. Chromatography (LC) and Gas Chromatography (GC) are extensively used to analyze stable compounds. However, for labile compounds require derivatization prior to LC or GC analysis. For certain selected analyses, Liquid Chromatography- Ultraviolet Detection (LC-UVD) and Gas Chromatography-Flame Ionization Detection (GC-FID) techniques may be deemed suitable. However, Liquid Chromatography-Mass Spectrometry (LC-MS) and Gas Chromatography-Mass Spectrometry (GC-MS) are usually the techniques of choice when higher specificity and sensitivity are required. Gas Chromatography-Electron Capture Detection (GC-ECD) techniques are commonly used for halogenated PGIs/GIs to enhance sensitivity and selectivity. Occasionally, some spectroscopic techniques like Nuclear Magnetic Resonance (NMR), light scattering, and Inductively Coupled Plasma-Mass Spectrometry (ICP-MS) are used in analyzing PGIs/GIs.

Track 13:Clinical trials and Pharmacovigilance

The global clinical trials market size was valued at USD 40.0 billion in 2016 and is expected to grow at a CAGR of 5.7% until 2025. The demand for biosimilars testing is expected to increase in the U.S. The interventional study design is the most prominent method of conducting clinical trials across with globe. According to statistics provided by the U.S. FDA, over 126,000 trials are currently being conducted by means of this method. Based on indication, the oncology segment is anticipated to witness the fastest growth. According to various sources, more than USD 38.0 billion is currently spent by the healthcare industry towards preclinical and clinical development of oncology therapy products. Hence, it is anticipated to grow at a lucrative CAGR and contribute over USD 15.0 billion towards the clinical trials market by 2025. MENA’s clinical trial revenues is expected to increase almost 10-fold over the next decade, which will build an annual market of about $1 billion.

Health economics is a tool to help us prioritise different and sometimes competing health care interventions for these fixed resources and, in doing so, health care is treated as a commodity like any other. Knowledge of health economics coupled with political insight is essential to understand resource allocation and expenditure in a modern health care system. Pharmacists, with their unique knowledge of medicine, are crucial in using pharmacoeconomic analysis to influence expenditure and distribution of resources on medicines. Design and management of pharmacoeconomic studies

• cost and burden of illness studies,

• drug utilization,

• budget impact analysis,

• modeling and simulations

are very important in today’s pharmaceutical market. Moreover pharmacoeconomic approach towards

• Management of Consensus Meetings (Advisory Boards, Delphi Panels, etc.)

• Re-analysis of trials

• Implementation and customization with local data of pharmacoeconomic models

have greatly aided the pharma industries.

Track 15:Drug Delivery Technologies & Drug Designing and Development

The global drug delivery technology market is projected to reach USD 1,669.40 Billion by 2021 from USD 1,179.20 Billion in 2016, at a CAGR of 7.2% during the forecast period. The North American drug delivery technologies market is projected to reach USD 758.7 Billion by 2021 from USD 520.0 Billion in 2016, at a CAGR of 6.5% during the forecast period. Bringing one new drug to the public typically costs a pharmaceutical or biotechnology company on average more than $1 billion and takes an average of 10 to 15 years. Each drug undergoes a stringent process of discovery, development, approval and finally, public use.

Track 16:Pharmaceutical Nanotechnology: Challenges and Opportunities

Pharmaceutical nanotechnology is most innovative field in the pharmaceutical industry. Nano technology is dealing with new emerging technologies. Application of nanotechnology in imaging, diagnostics and therapeutics is considered as an important factor. The drug delivery system positively impacts the rate of absorption, distribution, metabolism, and excretion of the drug or other related chemical substances in the body. Within regulatory boundaries thermodynamics and nanotechnology are considered to be evolving tools to provide new and integrated knowledge for the production of new medicines.

Nanotechnology speaks to a stage for creating progressive changes and enhancements to a wide range of parts of pharmaceutical assembling. Pharmaceutical nanotechnology has provided fine-tuned diagnosis and focused treatment of disease at a molecular level. Nano technology is having an utmost importance in Gene therapy.

Track 17:Use of Nanoparticles in DDS and Newer Methodologies

A particle with at least one dimension less than 100nm is a nanoparticle. They are composed of synthetic or semisynthetic polymers carrying drugs or proteinaceous substances. Nanoparticles have developed as capable vehicles to deliver drugs in the body. Nanoparticles comprising encapsulated, dispersed, absorbed or conjugated drugs have exceptional characteristics that can lead to higher performance in a variety of dosage forms. Nanoparticles are one of the novel drug delivery systems which can be of potential use in controlling and targeting drug delivery as well as in cosmetic textiles and paints. There are recent developments in the use of nanoparticles as drug delivery systems to treat a wide variety of diseases.

Track 18:Pharmaceutical Auditing for OTC Drugs

Non-prescription medicines, commonly known as over the counter or OTC medicines, are used for treatment. Sales of over the counter medicines in pharmacy and grocery outlets reached £1268 5 million in 1994 about a third of the NHS drugs bill of C3 6 billion. In the late 1980s the government fuelled the over the counter market by making it easier to reclassify certain medicines from prescription only status to allow over the counter sale in pharmacies. Although all non-prescription medicines are required to hold a product licence, few have been evaluated in formal clinical trials in the setting in which they will be used. As a result many non-prescription products sold by pharmacists have been criticised for their lack of effectiveness. There are three legal categories of medicines prescription only medicine (POM), pharmacy medicine (P), and general sales list medicine (GSL); the last can be sold from outlets including supermarkets and drugstores. The principle of a class of medicines whose sale requires the supervision of a pharmacist is not unique to the United Kingdom.

Track 19:Importance of Audit in Pharmaceutical Industry

International Organization for Standardization (ISO) 9000 requirements do not have the same status of “the law” in the U.S. as do requirements listed in the Code of Federal Regulations (CFR). Because 21 CFR 210 and 211 have legal status, the U.S. Justice Department has extensive powers to ensure compliance. For example, product in the marketplace can be seized, fines can be levied, and personal liability can be assigned. So, management must understand that auditing must be taken seriously, and the requirements listed are just that – requirements. While audits are the common place in the pharmaceutical industry, the preparedness for those events varies. The companies that develop a risk-based approach to audits are able to remain competitive while meeting quality and government compliance standards on a regular basis. Conversely, the companies that have not implemented strong processes are putting themselves at risk for non-compliance. According to the Federal Food, Drug and Cosmetic Act, “Registered domestic drug establishments shall be inspected by the FDA at least once every two years.” Under some conditions the inspections may be even more frequent, As regulations become more stringent, regulatory authorities are likely to step up audits which is even more reason for companies to be prepared.

Track 20:Biologics and Biosimilars

A biopharmaceutical, otherwise called a biologic therapeutic item or biologic, is any restorative item made in, extricated from, or semi orchestrated from organic sources. Not quite the same as synthetically incorporated pharmaceuticals, they incorporate immunizations, blood, or blood segments, allergenic, substantial cells, quality treatments, tissues, recombinant restorative protein, and living cells utilized as a part of cell treatment. Biologics can be made out of sugars, proteins, or nucleic acids or complex mixes of these substances, or might live cells or tissues. They are confined from normal sources—human, creature, or microorganism. Phrasing encompassing biopharmaceuticals fluctuates amongst gatherings and elements, with various terms alluding to various subsets of therapeutics inside the general biopharmaceutical class. Some administrative offices utilize the terms natural restorative items or remedial organic item to allude particularly to designed macromolecular items like protein-and nucleic acid–based drugs, recognizing them from items like blood, blood segments, or antibodies, which are typically extricated specifically from a natural source Gene-based and cell biologics, for instance, frequently are at the front line of biomedical research, and might be utilized to treat an assortment of therapeutic conditions for which no different medications are accessible.

Track 21:Regulatory Authority Compliance

With more stringent compliance parameters set by the USFDA the quality assurance of pharmaceutical products is ensured. In addition to cGMP, GLP and GCP practices as per the US Federal law pharma products should comply with 21CFR regulations. Also on a regular basis the FDA organizes compliance programs for the pharma industries in program areas like Biologics (CBER), Bioresearch Monitoring (BIMO), Devices/Radiological Health (CDRH), Drugs (CDER), Food and Cosmetics (CFSAN), Veterinary Medicine (CVM). The results of regulatory audits NAI – No Action Indication, VAI – Voluntary Actions Indicated, OAI – Official FDA Action Indicated are also critical to decide by auditors in regards to compliance matters and call for several challenges to overcome by the manufacturers.

Track 22:Pharma Market Research

Two powerful megatrends — dramatic deceleration in U.S. market growth and significant restructuring of the healthcare system — are at play in the U.S. pharmaceuticals industry. The U.S. pharmaceutical market is the world’s most important national market. Together with Canada and Mexico, it represents the largest continental pharma market worldwide. The United States alone holds over 45 percent of the global pharmaceutical market. In 2016, this share was valued around 446 billion U.S. dollars. The biopharmaceutical companies in the United States exported goods in the amount of some 31 billion U.S. dollars during 2016. In the United States, there are an estimated 100,000 OTC drug products marketed and sold in a variety of outlets, such as pharmacies and convenience stores. TH revenue for the OTC drugs also add to the pharma market growth. Top markets for pharmaceutical products continue to be developed countries in Western Europe, East Asia, and North America with high per capita spending on healthcare, growing elderly populations, and advanced regulatory systems. Though ranked lower, there are growing opportunities in developing countries like China as incomes and healthcare spending increases. The pharmaceutical sector has consistently been one of the most R&D intensive industries in the United States. The research-based industry generally allocates around 15 to 20 percent of revenues to R&D activities and invests over $50 billion on R&D annually.

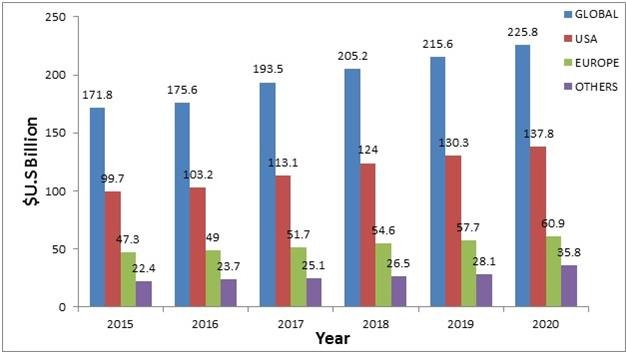

Glance at Market of Pharma Research and Development:

The United States is the world’s largest market for pharmaceuticals and the world leader in biopharmaceutical research.The global market for pharmaceutical Research was $70.1 billion in 2017 and $68.9 billion in 2019and this market is expected to rise at a compound annual growth rate (CAGR) of 2.3% from 2013 to 2018 and reach $77.1 billion by 2018 and the global advanced Pharma Research market should grow from roughly $178.8 billion in 2015 to nearly $227.3 billion by 2020, with a compound annual growth rate (CAGR) of 4.9%.The major attraction includes Liberty Bell, Franklin Institute, Eastern State Penitentiary, Barnes Foundation and many more.

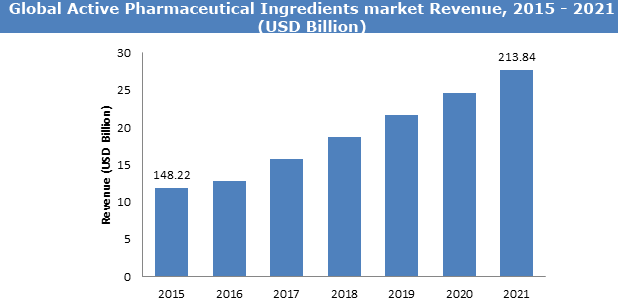

Active Pharmaceutical Ingredient Market:

Transparency Market research states the opportunity in this market will be worth US$219.60 bn by 2023 from US$134.7 bn in 2015. Between the forecast period of 2015 and 2023, the overall market is expected to expand at a CAGR of 6.3%. Between the forecast period of 2015 and 2023, the overall market is expected to expand at a CAGR of 6.3%.

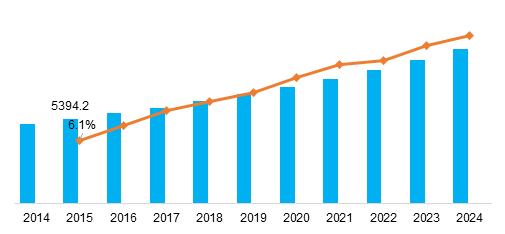

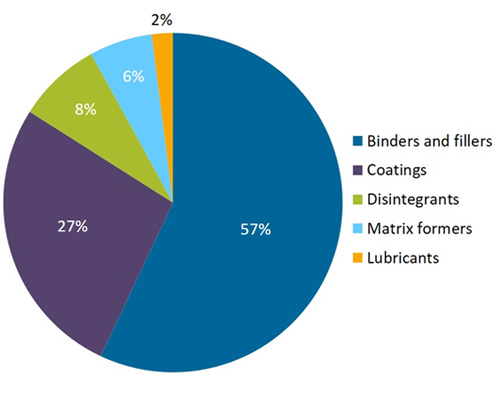

Pharmaceutical Excipients:

The global pharmaceutical excipients market is projected to reach USD 8.1 Billion in 2021 at a CAGR of 6.1% in the forecast period 2016 to 2021. The rising demand for new drug delivery systems, greater understanding of the functional benefits of excipients, growing pharmaceutical industry, and patent expiries of several blockbuster drugs are positively impacting the overall growth of the market.

Global Pharmaceutical excipients Market, by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe (RoE)

- China

- Japan

- India

- Rest of APAC

- Latin America

- Middle East & Africa

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Major Marketing Associations around the Globe:

- International Institute of Marketing Professionals (IIMP®)

- Marketing Power (American Marketing Association -AMA)

- American Branding Association (ABC)

- Canadian Marketing Association (CMA)

- Marketing Education Association (MEA)-USA

- Association for Consumer Research (ACR)

- The Asia-Pacific Professional Services Marketing Association (APSMA)

- Association of Internet Marketing and Sales (AIMS)-Canada

For conference attendance and participation only Business Visa should be applied. Contact your nearest travel agent/visa information center/Canada Embassy for the correct application form.

All visas for visiting Canada shall be processed by respective authorities only upon submission of proper documents through proper channel.

In case of non-furnishing of documents, non-adherence to guidelines visas shall be cancelled by respective authorities.

The minimum supportive documents that might be required while applying for Canada visa include:

Letter of invitation,

Abstract acceptance letter (if speaker),

Registration payment receipt,

Accommodation confirmation letter issued under conference letter head.

For letter of invitation and accommodation confirmation, payment of registration fees and accommodation charges is a pre-requisite.

Mandate documents required from conference secretariat should be obtained only through Jessie Rose

For more details please contact

Ria Smith

Program Manager

Pharma Research 2022

E: pharmaresearch@eventqueries.com

Whats app: +1 7632605577

Conference Highlights

To share your views and research, please click here to register for the Conference.

To Collaborate Scientific Professionals around the World

| Conference Date | June 29-30, 2022 | ||

| Sponsors & Exhibitors |

|

||

| Speaker Opportunity Closed | |||

| Poster Opportunity Closed | Click Here to View | ||

Useful Links

Special Issues

All accepted abstracts will be published in respective Our International Journals.

Abstracts will be provided with Digital Object Identifier by